How to Enroll in the End-of-Service Savings Scheme in UAE 2026 (Guide)

How to Sign up/Enroll For Savings Scheme

For Employers: Enrollment in the Savings Scheme requires proactive steps by the employer, since it is a company-level initiative. The process involves:

- Applying to MOHRE: An employer must formally submit a request to MOHRE to subscribe to the voluntary alternative end-of-service benefits system. This can typically be done through MOHRE’s online portal or service centers. Once that’s done, they can enroll selected employees, making sure all previously earned gratuity is preserved in line with UAE Labour Law.

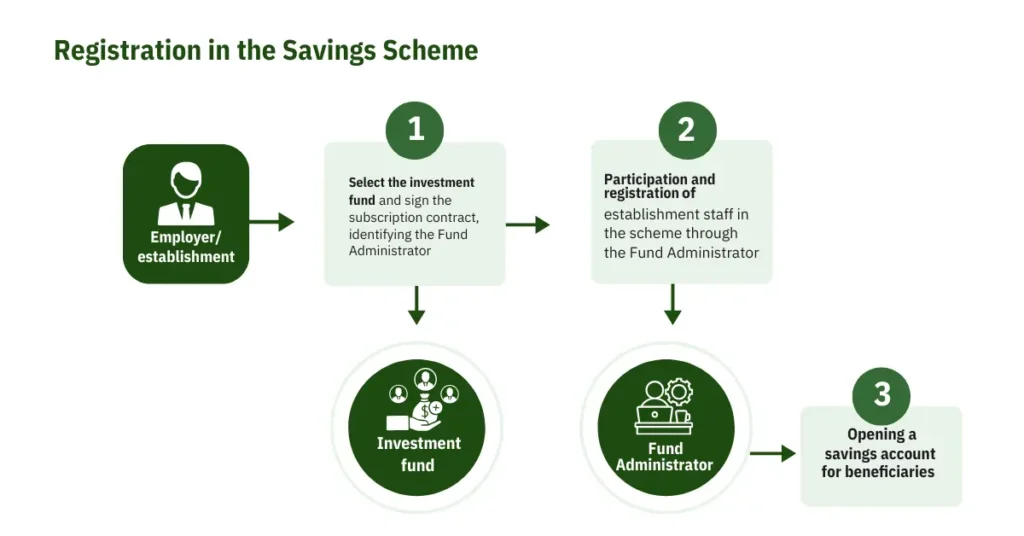

- Selecting an Approved Fund: The employer chooses one of the SCA-licensed investment funds listed by MOHRE to manage the savings. Options include government-approved financial institutions and investment companies that offer dedicated end-of-service investment plans. Employers will sign a contract with the chosen fund manager as part of the enrollment.

NAME

PHONE

WEBSITE

BROCHURE

Savings Scheme Registration Process:

- Defining Scope of Enrollment: The employer decides which employees will be enrolled. It could be all staff or a specific category (for example, those above a certain grade or new hires going forward). The scheme covers private sector and free zone employees (optional for expatriates as well as UAE national employees in those sectors, though Emiratis already have pension schemes). Once an employee category or list is chosen and the scheme is implemented, inclusion becomes mandatory for those employees – individual employees cannot opt out if their company has enrolled them.

- Preserving Past Entitlements: Before switching to the new system, the employer must calculate any gratuity accrued for each selected employee up to the date of joining the scheme by using our free online Gratuity Calculator UAE. These accrued benefits from the “previous period” must be preserved (usually paid out to the employee at the end of service as per the law). In other words, an employee doesn’t lose the gratuity they earned prior to the scheme; that amount is safeguarded, and going forward the Savings Scheme takes over accruing benefits.

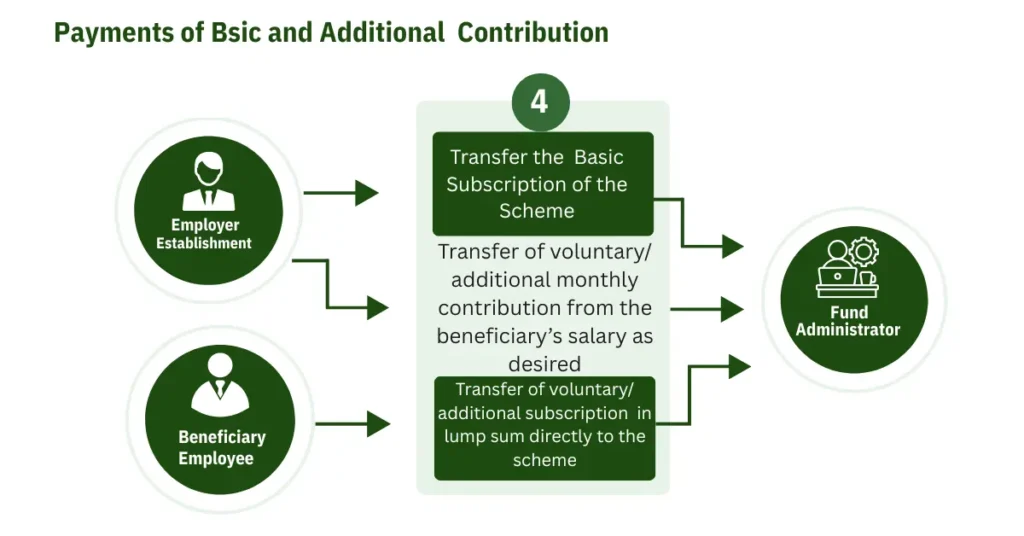

- Begin Contributions: After MOHRE approval and setup with the fund, the employer will commence the monthly contributions as described earlier (5.83% or 8.33% of basic salary, paid by the employer without deduction from wages). These payments continue throughout the employees’ service or until any withdrawal from the scheme.

- Compliance and Administration: The employer must ensure timely monthly payments. If an employer fails to pay the required contributions on time, the scheme’s regulations impose escalating measures: a written notice from the fund manager within 30 days, notification to MOHRE if non-payment persists, potential suspension of new work permits after 2 months of non-payment, and fines of AED 1,000 per employee per month for prolonged non-payment. Thus, employers need to treat these contributions with the same seriousness as wage payments.

MOHRE has also set conditions for employers who may later wish to withdraw from the scheme (since it’s voluntary). An employer must participate for at least one year before exit, have no outstanding fines or labor disputes, and provide a financial guarantee that employees’ gratuities will be paid out in full upon exit. If an employer withdraws after meeting conditions, any future service of employees will revert to the standard gratuity system, but employees’ rights under the scheme for the period enrolled remain protected.

For Employees: Individual employees cannot enroll themselves in the core Savings Scheme (it’s not like a personal account one can open unilaterally). Your employer is the one to sign up and register you. However, employees should:

- Stay Informed: Understand your company’s policy – if your employer opts in, they should inform you and perhaps provide options regarding investment choices (if you’re a skilled worker). Be aware that once enrolled, you will no longer accrue gratuity under the old system for that period, but you will be gaining contributions in the fund.

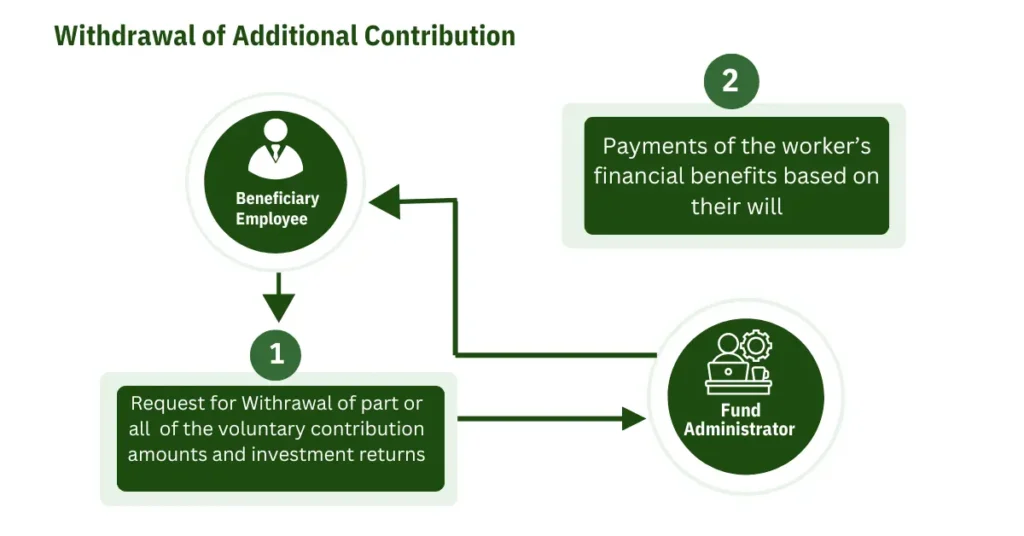

- Voluntary Contributions: If you wish to boost your savings, communicate the desired voluntary contribution (percentage or amount) to your employer/payroll or directly arrange it with the fund if allowed. Remember the 25% of salary cap on extra contributions.

- Beneficiary Nomination: Just as with any financial plan, ensure you’ve updated beneficiary information for your savings account (so that in case of unforeseen events, your rightful heirs receive the funds promptly, as the scheme rules provide).

- Track Your Savings: Employers are encouraged to provide account statements or online access to the fund’s portal. Monitor your balance and returns over time. This transparency is one advantage of the scheme – you can see your end-of-service benefit growing, rather than just a notional amount accruing on paper.

By knowing how the enrollment works, employees can engage with their HR departments to discuss the potential of joining the scheme or at least be prepared if the company announces participation. Given the scheme’s optional nature for companies, employee interest and feedback might even encourage an employer to consider subscribing for the benefit of their workforce.

We hope this material will be helpful for you 🙂